Finding the right CRM software for your small business can make a world of difference in how you connect with customers, manage relationships, and drive growth.

With the right system, you can streamline everything from tracking sales leads and automating marketing efforts to handling customer service interactions—all within one platform. However, the CRM needs of small businesses are unique.

Unlike large corporations with extensive budgets and complex requirements, small businesses often look for affordability, ease of use, and features that scale as they grow.

This guide will discuss some of the top CRM software options tailored specifically for small businesses. Our experts have reviewed each software and evaluated its ease of use, pricing structure, customer support, and essential features. By the end, you’ll clearly understand which CRM solution best meets your needs.

What Is CRM Software for Small Businesses?

CRM (Customer Relationship Management) software is a tool designed to centralize and optimize a business’s management of customer interactions. It helps companies grow by enabling them to build better relationships.

These platforms organize contact information, track communication history, and allow for automated sales, marketing, and business processes. For small businesses, CRM software supports efficient customer engagement and operational productivity by providing an accessible (and often budget-friendly) way to manage leads and foster customer loyalty.

With features like automated email marketing, task management, lead tracking, and reporting, a CRM empowers a small team to handle customer relations effectively without needing extensive resources. Many CRM options offer scalable solutions. Therefore, you can start with essential features and expand as your business grows.

The Benefits of CRM Software for Small Businesses

Here are the essential benefits a CRM platform offers, especially tailored to small businesses:

Enhanced Customer Service

CRM platforms consolidate customer data, enabling small businesses to deliver efficient, personalized support.

Access to a customer’s full interaction history enables your support team to address inquiries more effectively. It also reduces response times, as customer representatives can quickly locate relevant information to provide timely assistance. Overall, this enhances customer satisfaction and retention.

Streamlined Data Management

By centralizing customer information, CRMs eliminate scattered records across different tools and create a single source of truth. This streamlined approach allows employees to access, update, and share customer information easily. It ensures consistency and minimizes data loss or duplication. In addition, this organization promotes smooth, coordinated efforts across departments.

Productivity Through Automation

Automating repetitive tasks like data entry, follow-ups, and email reminders saves valuable time for small business teams. CRMs automate these workflows. They allow employees to focus on strategic activities, such as customer engagement and business development, rather than on routine administrative tasks. This results in higher productivity and fewer chances for human error.

Improved Sales Forecasting and Tracking

CRMs enable small businesses to track and analyze sales metrics, such as conversion rates and sales cycle length, providing real-time insights for more accurate forecasting.

With this data, businesses can adjust their strategies, anticipate demand, and set realistic goals. This ultimately improves sales performance and ensures resource allocation aligns with sales projections.

Enhanced Customer Segmentation and Marketing

CRM systems help small businesses segment customers based on demographics, purchase history, and engagement. This segmentation allows for targeted marketing and personalized communication, which increases the likelihood of conversion.

Small businesses can optimize marketing spend and create campaigns that resonate better with their audience by focusing on specific customer groups.

CRMs also provide insights into which marketing channels and messages generate the highest engagement for their audience(s). With this data, small businesses can refine their marketing strategies to focus on the most effective campaigns. As a result, it improves ROI and reduces wasted resources on underperforming initiatives.

Support for Business Growth and Scalability

As small businesses grow, so do their data and process needs. CRMs offer scalability, which allows businesses to accommodate more customers, expand user access, and add new features without changing platforms. This flexibility ensures the CRM adapts to evolving needs. It supports sustainable growth without data migration or system overhaul.

Increased Customer Retention

CRMs track customer interactions and behaviors. They enable businesses to anticipate customer needs and personalize outreach. Small businesses can therefore strengthen relationships by addressing customer preferences and proactively following up on feedback. This reduces churn rates and fosters long-term loyalty.

Improved Internal Collaboration

CRMs serve as a hub for cross-departmental collaboration. They provide all team members access to customer information. This transparency ensures that sales, marketing, and support teams are aligned, which enhances coordination and reduces the risk of miscommunication. Improved collaboration leads to a cohesive customer experience and a more productive workplace.

Data-Driven Decision Making

Detailed analytics and reporting capabilities empower small businesses to make informed, data-driven decisions. CRMs generate insights into customer behaviors, sales performance, and market trends. They guide strategic planning and allow businesses to pivot effectively. By leveraging accurate data, small businesses can adjust tactics proactively to optimize growth and customer engagement.

Signs That You Need A CRM for Your Small Business

Below are some of the signs that you need a CRM platform:

Your Customer Data Is All Over the Place

As an entrepreneur, you may find yourself juggling customer information across spreadsheets, email chains, and sticky notes. If this is the case, it’s a strong indicator you need a CRM.

Disorganized data management often leads to missed opportunities, duplicated efforts, and frustrated customers who may feel unrecognized or undervalued. A CRM centralizes all customer data in one accessible place. It gives you a single source of truth for each client interaction, from purchase history to contact details.

Communication Between Teams Is Disconnected

When your customer service, marketing, and sales teams lack easy access to shared information, efficiency suffers. A CRM promotes collaboration by ensuring every department can access real-time, up-to-date customer insights, preventing missed information and enabling seamless follow-up. It allows team members to coordinate efforts smoothly. This enhances customer experience and reduces friction in internal communication.

Managing Leads Is Overwhelming

Handling multiple leads manually often results in missed follow-ups or late responses. CRMs help organize leads in a clear pipeline and automate follow-ups so no opportunity slips through the cracks. This makes it easier to prioritize high-quality leads, assign them to the right team members, and keep track of where each lead stands in the entire sales process.

Data Entry Is Consuming Too Much Time

If your team is spending too much time on manual data entry, it’s time for a CRM. Automation in small business CRM reduces repetitive tasks. It allows data from emails, website forms, or other sources to be automatically recorded and updated in the system. This frees your team to focus on more valuable activities, such as engaging with customers or closing sales.

Reporting and Analytics Are Time-Consuming

Generating accurate, detailed reports can become a burden when data is spread across various tools. A CRM for small business operations simplifies reporting by consolidating data. It enables you to pull reports instantly with real-time insights on sales performance, customer interactions, and marketing efforts. This data visibility helps you make better, data-driven decisions to improve business outcomes.

Tracking Customer Interactions Is Challenging

Without a centralized system, tracking interactions across multiple channels—emails, calls, social media—becomes complex and error-prone. A CRM system captures each and every touchpoint, creating a clear interaction history that any team member can access. This enables more meaningful conversations with customers and ensures consistency, regardless of who they interact with.

You Can’t Access Data Remotely

In today’s remote work environment, flexible, cloud-based customer data access is crucial. One of the reasons why we recommend a CRM is because it allows you and your team to access information from anywhere, on any device. Whether working from home or on the go, your team can view the latest updates. This ensures they’re always ready to engage with customers effectively.

You’re Struggling to Identify Key Customer Segments

Understanding your customer base is essential for targeted marketing and personalized service. A CRM segments customers based on purchase behavior, preferences, and demographics. It helps you tailor communications and identify high-priority accounts for upselling or nurturing. This insight boosts your marketing effectiveness and improves customer satisfaction.

CRM Software for Small Business: 8 Top Solutions

Here are our top picks for the best CRM software for small businesses:

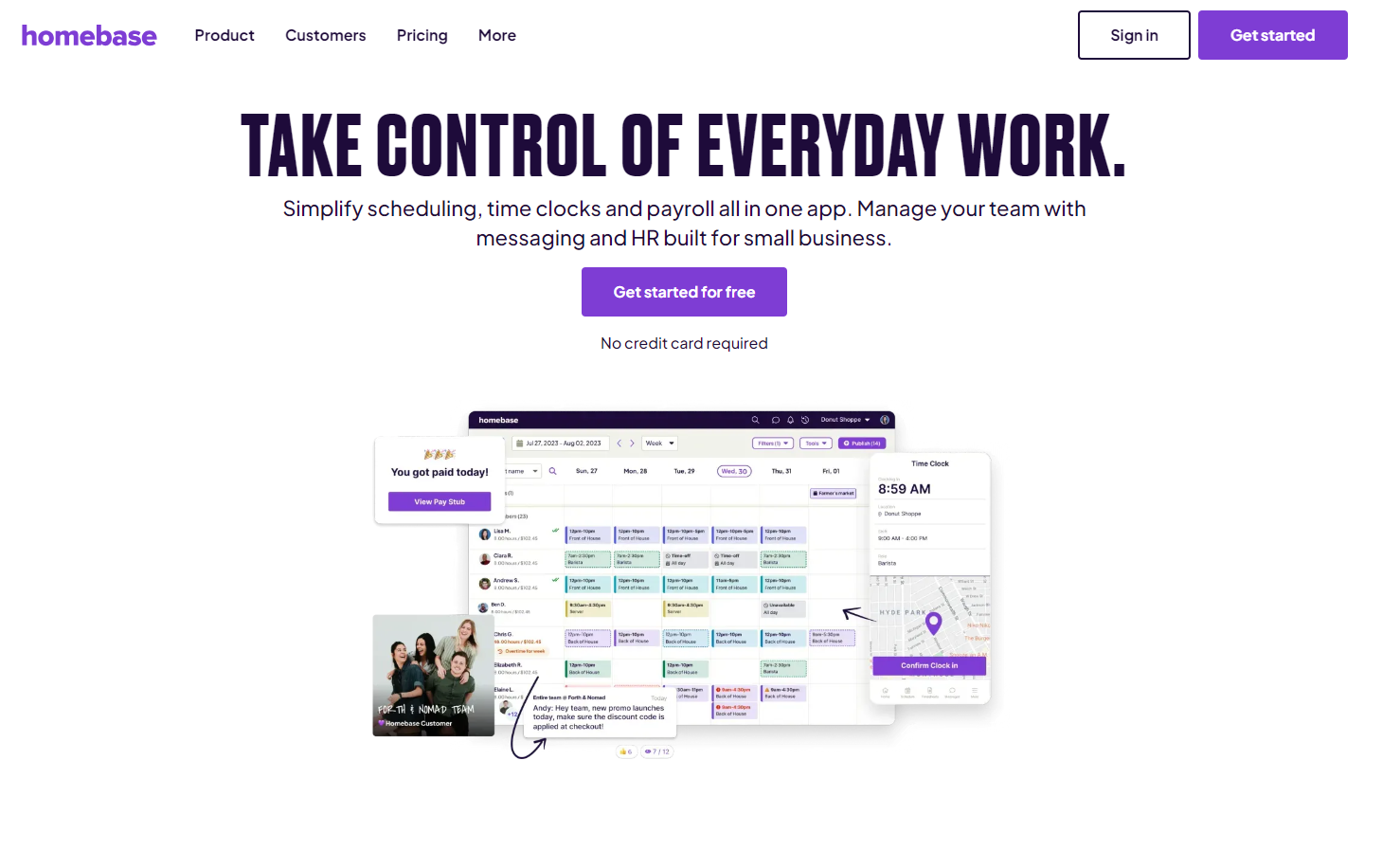

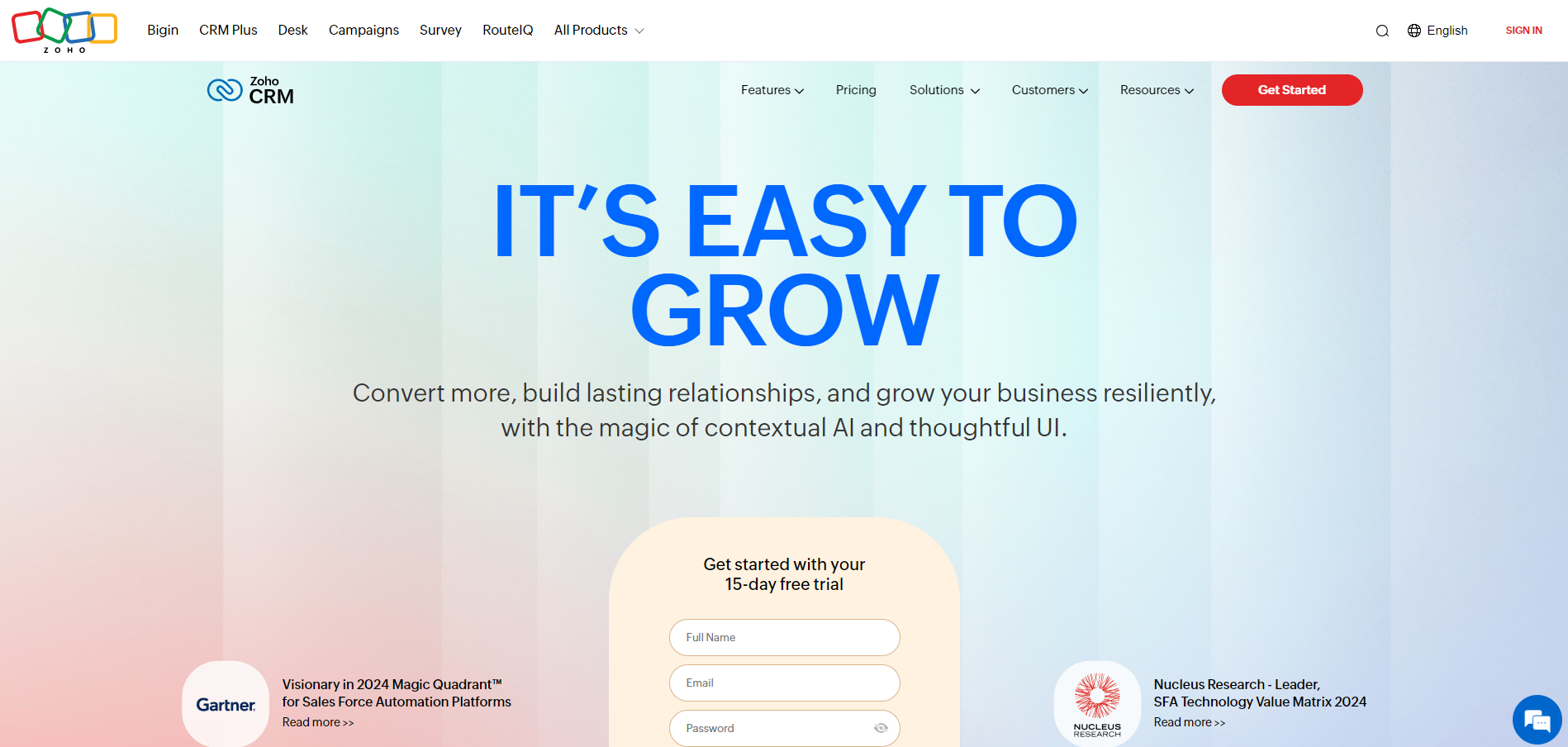

1. Zoho CRM

Zoho CRM is an adaptable and affordable CRM solution ideal for small businesses. It offers a free CRM plan for up to three users and has a range of competitively priced tiers to accommodate growing teams and businesses on a budget.

Zoho CRM integrates sales, marketing, and customer service tools. These tools allow teams to track leads, manage customer interactions, and automate workflows within a single platform. One standout feature is Zoho’s AI assistant, Zia, which helps with lead scoring, workflow automation, and even sales predictions to boost decision-making.

Additionally, Zoho’s vast app marketplace supports easy integration with other popular tools, such as Google Workspace, Microsoft 365, and Mailchimp, which enhances its flexibility and functionality.

Key Features

- Zia AI Assistant: Provides lead scoring, workflow recommendations, and sales predictions.

- Omnichannel Communication: Manages customer interactions across email, phone, live chat, and social media.

- Sales Forecasting: Offers tools to predict revenue and identify trends in customer behavior.

- Lead Management: Automates lead routing, scoring, and assignment for optimized handling.

- Customizable Dashboards and Reporting: Enables data visualization with over 40 pre-built report templates and custom dashboards.

- Extensive App Marketplace: Supports integration with over 1,000 third-party apps and tools.

Pros

- Offers a free plan for small teams (up to three users), making it budget-friendly.

- Extensive customization options allow businesses to tailor the CRM to specific workflows.

- Built-in AI assistance (Zia) provides advanced lead scoring and sales insights.

- A broad range of integrations and an expansive app marketplace.

Cons

- Limited features in the free and entry-level plans. You must upgrade for more robust functionality.

- Customer support on lower plans is limited to business hours (8/5), which may affect response times.

- Some users report a steep learning curve due to Zoho’s extensive features and customization options.

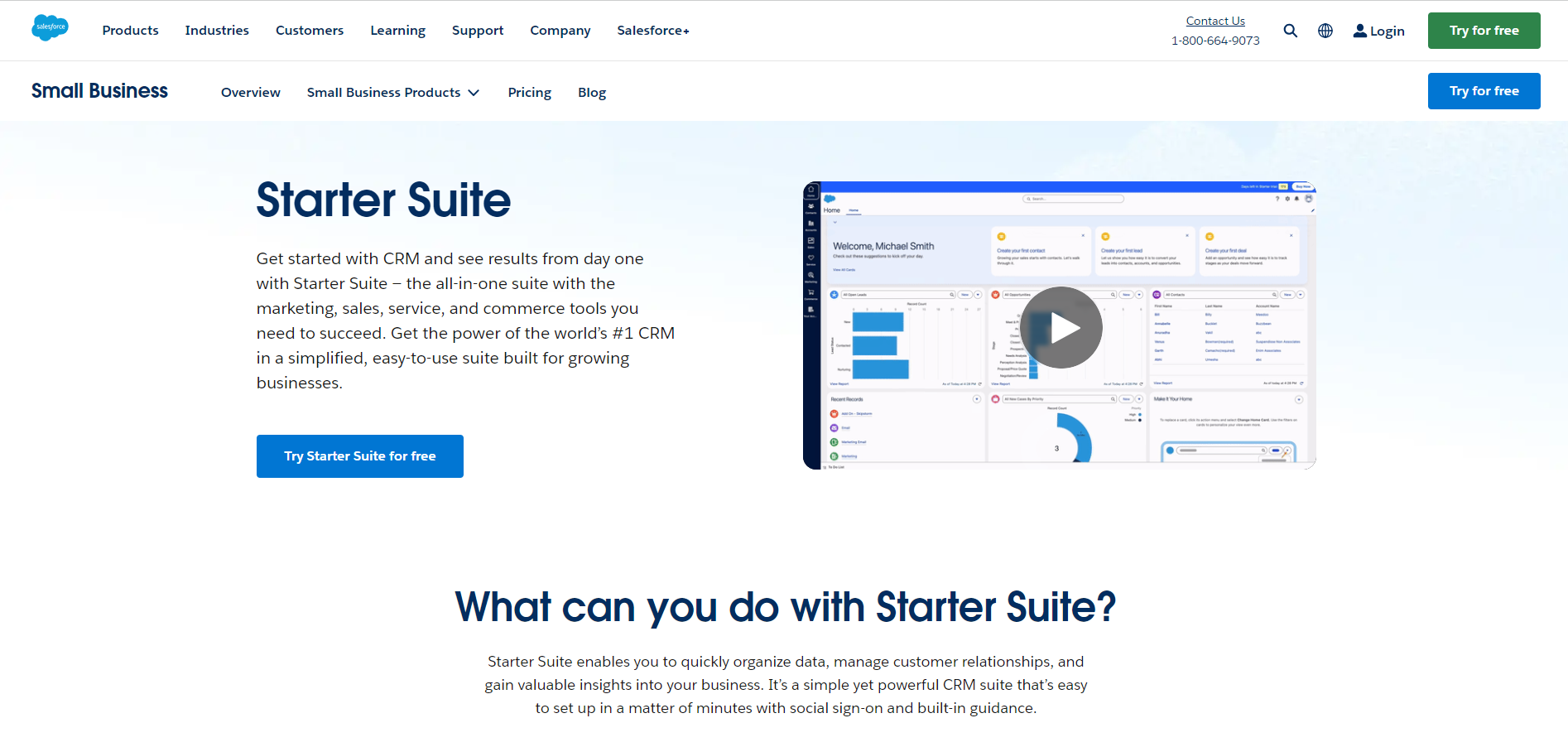

2. Salesforce Starter

Salesforce Starter, designed for small businesses, is an all-in-one CRM solution that consolidates sales, marketing, and customer service tools into a single platform.

Priced at $25 per user per month, it provides small businesses with access to Salesforce’s robust features while maintaining simplicity. The platform offers preconfigured settings, an intuitive onboarding experience, and a streamlined interface. This makes it easy to set up and start using quickly.

With integrations for Gmail, Outlook, and other essential tools, Salesforce Starter enables small teams to manage customer relationships, track leads, and run campaigns efficiently. Additionally, Salesforce’s AI-powered features, such as Einstein, provide insights into sales opportunities. They optimize workflows and enhance team productivity.

Key Features

- Salesforce Einstein AI: Offers lead scoring, opportunity insights, and activity tracking.

- Preconfigured Templates: Ready-to-use sales and service templates for faster onboarding.

- Email Integration: Connects seamlessly with Gmail and Outlook for better email management.

- Case Management: Includes automated case routing for streamlined customer support.

- Sales and Marketing Automation: Automates repetitive tasks, enabling personalized outreach and follow-ups.

- Customizable Dashboards and Reports: Provides detailed analytics and real-time data for informed decision-making.

Pros

- Affordable for small businesses compared to other Salesforce plans.

- AI-powered insights (Einstein) optimize sales strategies and prioritize high-value leads.

- Strong integration options through Salesforce’s AppExchange marketplace.

- Includes guided onboarding and pre-set workflows, reducing setup time.

Cons

- Limited customization compared to Salesforce’s more advanced plans.

- May have a learning curve for teams new to Salesforce or CRMs in general.

- Some advanced features are locked behind higher-tier Salesforce subscriptions. This limits flexibility as businesses grow.

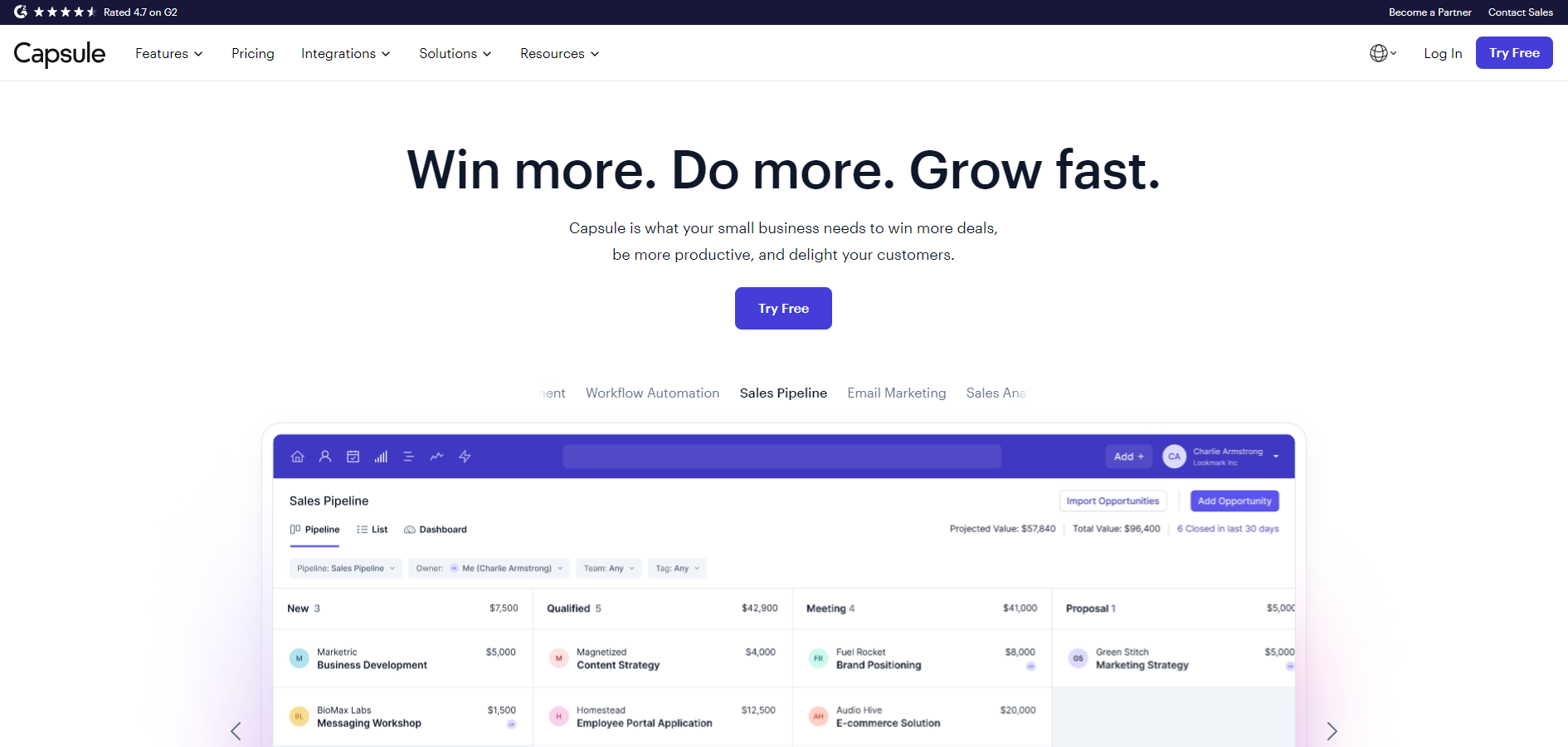

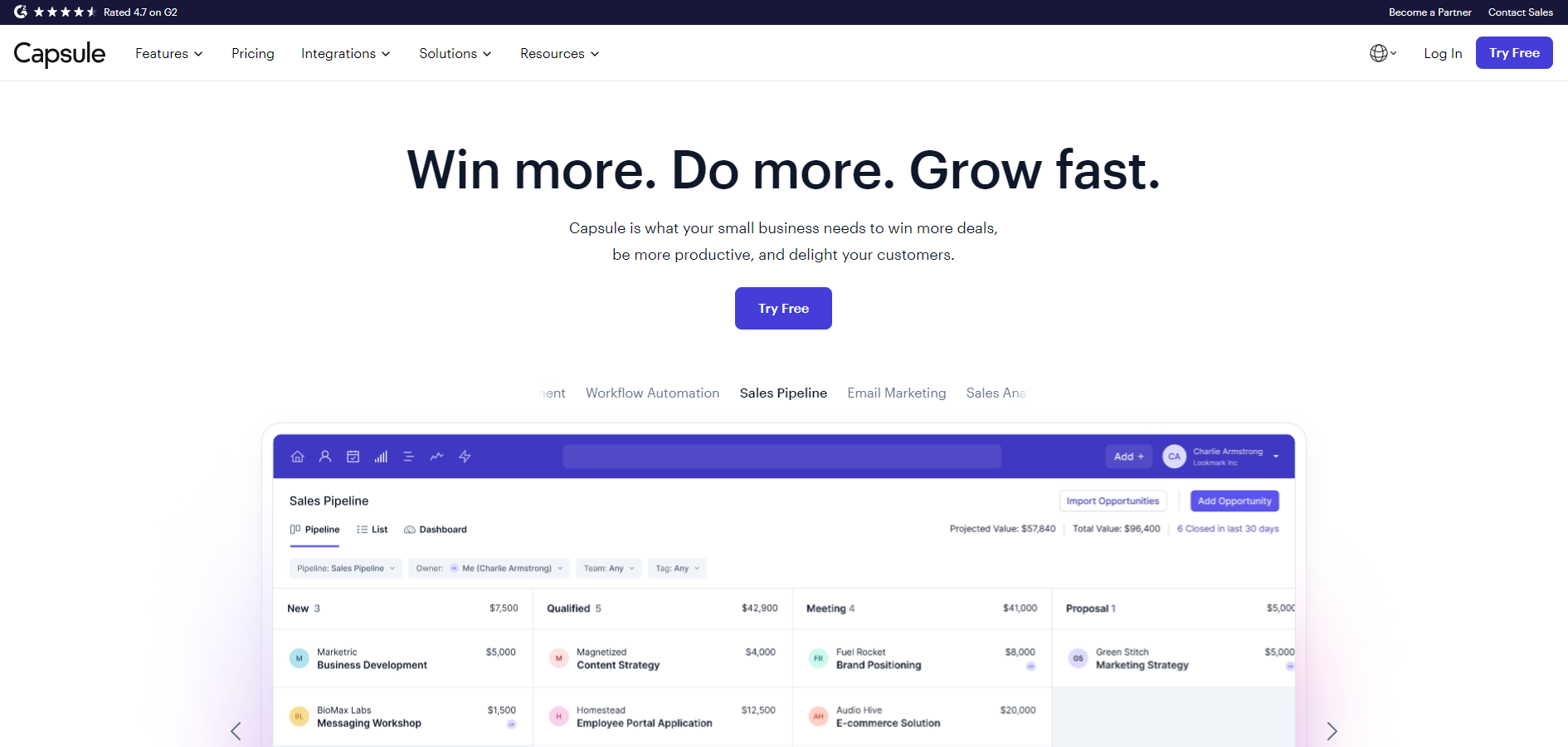

3. Capsule CRM

Capsule CRM is a user-friendly and affordable CRM solution tailored for small and growing businesses. It offers an intuitive contact management system that allows businesses to store and organize customer information, track interactions, and manage sales opportunities.

Capsule’s simplicity and ease of setup make it ideal for teams without extensive technical expertise. The platform’s sales pipeline management features enable users to visually manage deals through custom milestones and identify “stale” deals that require attention.

This CRM software for small businesses also integrates well with Gmail and Outlook so that you can create contacts and manage tasks directly from their inbox. Additional integrations with tools like Xero and QuickBooks support financial management. Capsule is a versatile CRM choice for small businesses looking for basic yet efficient functionalities.

Key Features

- Sales Pipeline Management: Customizable pipeline views (Kanban, list, and dashboard) for tracking sales team deal progress.

- Email Integration: Seamless connection with Gmail and Outlook for managing customer emails within the CRM.

- Task and Calendar Management: Ability to create, assign, and repeat tasks linked to specific contacts and sales.

- Mobile App: Accessible on iOS and Android, enabling remote access to contacts, tasks, and sales opportunities.

- Customizable Reporting: Offers sales analytics for monitoring team performance and tracking sales metrics.

Pros

- Simple and straightforward interface suitable for small businesses and new CRM users.

- Free plan available for startups and small teams, supporting up to 250 contacts.

- Integrates with popular apps (e.g., Xero, QuickBooks, Mailchimp) and supports contact management on the go via mobile.

- Customizable sales pipeline views and automation options for repetitive tasks.

Cons

- Limited advanced features on the free plan, with no reporting options unless upgraded.

- Fewer marketing automation tools and integrations compared to other CRMs.

- Some users report limited customization options for more complex workflows.

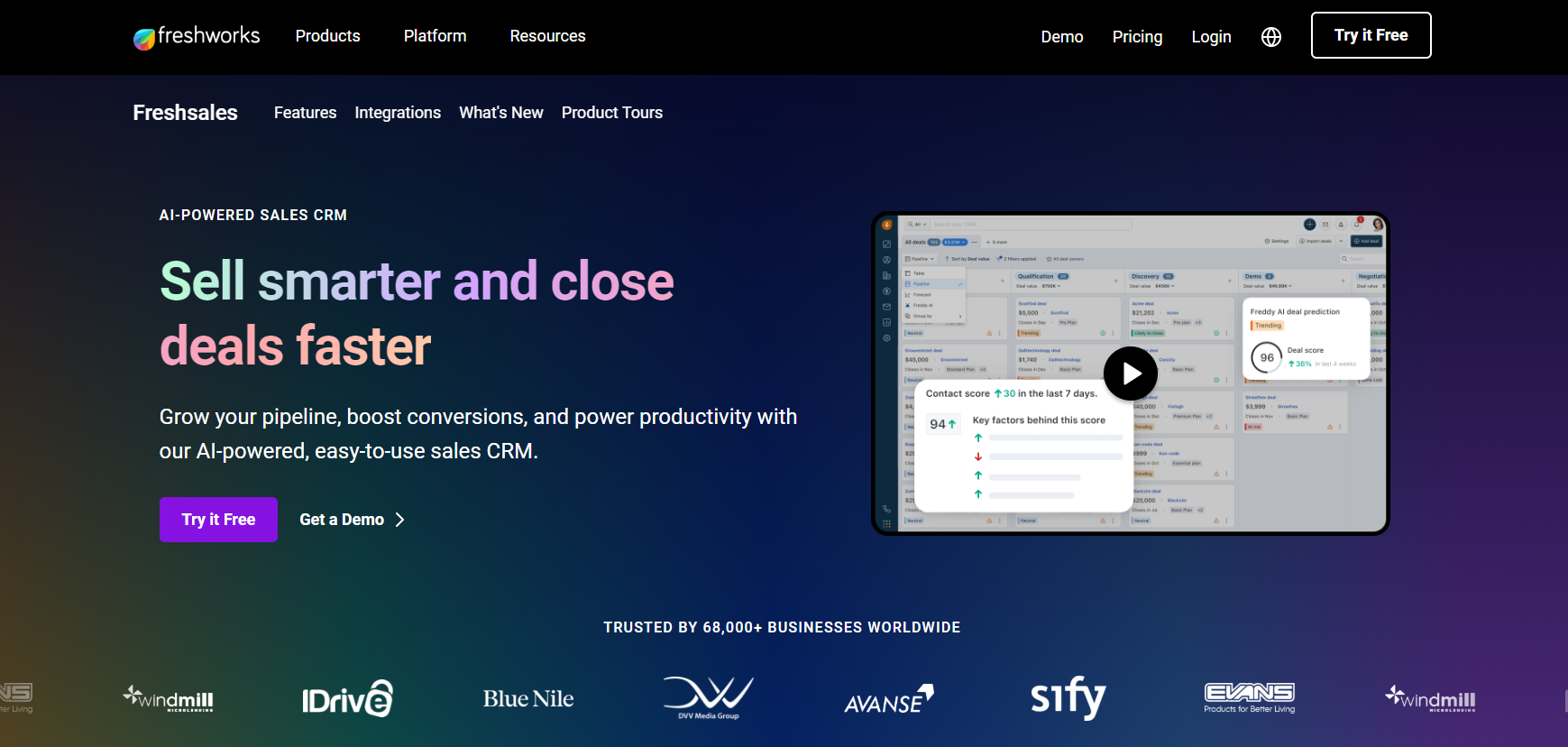

4. Freshsales CRM

Freshsales CRM, part of the Freshworks suite, is made for sales-driven teams seeking an intuitive platform to manage leads, track deals, and accelerate sales processes.

Known for its user-friendly interface, Freshsales integrates AI-driven features like Freddy AI, which assists with lead scoring, revenue forecasting, and in-call recommendations for real-time conversation insights. It provides a 360-degree contact management view. This allows users to see a timeline of interactions, track communications, and manage follow-ups seamlessly.

Freshsales is highly customizable, with flexible sales pipelines that teams can tailor to their processes, multiple communication channels (email, phone, live chat), and a built-in telephony service for direct calls. With its mobile app, Freshsales supports sales activities on the go, making it ideal for field reps or remote teams.

Key Features

- Freddy AI: AI-powered insights for lead scoring, forecasting, and duplicate data cleanup.

- Sales Pipeline Management: Visual pipelines in Kanban, list, and timeline views for efficient deal tracking.

- In-Built Telephony: Built-in call capabilities with local and toll-free numbers, call recording, and caller ID.

- Automated Workflow: Automates routine tasks, from lead assignment to follow-up reminders.

- Mobile CRM: Mobile app for on-the-go access to contacts, tasks, and pipelines.

- Lead Scoring and Routing: Scores leads based on engagement and routes them to the appropriate team members.

- Customizable Reports and Dashboards: Premade templates and custom dashboards for performance tracking.

Pros

- User-friendly and intuitive interface with a minimal learning curve.

- Powerful AI features assist in prioritizing leads and providing real-time sales insights.

- Comprehensive communication tools (email, phone, and live chat) built into the platform.

- Flexible pricing plans with affordable options for small to medium-sized businesses.

Cons

- Limited integrations compared to some competitors.

- Lacks advanced marketing tools, like form builders or landing pages, found in other CRM solutions.

- Reporting features are limited on the free plan, which may require an upgrade for analytics.

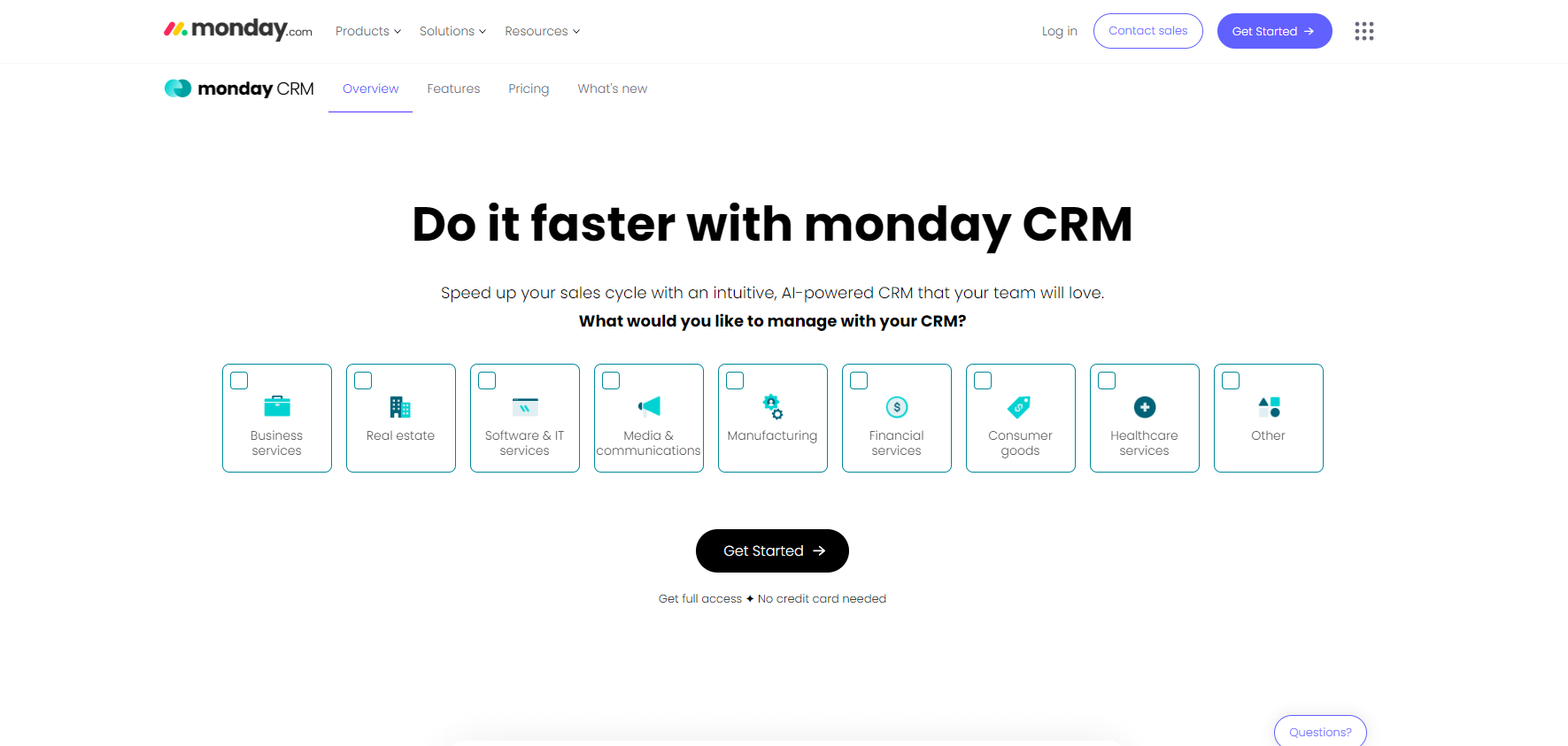

5. Monday.com

Monday CRM is a highly customizable and visually intuitive CRM tool engineered to help small and medium-sized businesses streamline sales, project management, and team collaboration.

Known for its flexibility, Monday CRM lets users create custom workflows and dashboards that cater to diverse business needs. This includes lead tracking, customer relationship management, and post-sale activities.

Monday’s visual data tools, like Kanban and Gantt views, enable users to track deals through drag-and-drop pipelines, while extensive automation options simplify repetitive tasks.

Designed with ease of use in mind, this small business CRM software offers a wide range of integrations with popular tools like Slack, Mailchimp, and Gmail, along with pre-set templates for different workflows. It’s ideal for teams looking to improve efficiency without a steep learning curve.

Key Features

- Customizable Dashboards: Track projects, KPIs, and budgets with over 15 widget options.

- Automated Workflows: Automate tasks, notifications, and deal movement through easy if/then logic.

- Data Visualization: Offers views in Kanban, Gantt, and Cards for clear, accessible data tracking.

- Lead Management: Manage leads with tools for lead capture, duplication removal, and workflow automation.

- Team Collaboration Tools: Shared boards, guest access, and real-time updates for smooth communication.

- Mobile App: Access CRM features on the go, ideal for remote or field-based teams.

Pros

- High customization, allowing users to adapt the CRM to specific needs and workflows.

- Intuitive, visually appealing interface with multiple data views.

- Strong integration capabilities with over 50 popular tools and platforms.

- Extensive online resources and support documentation to aid setup and user training.

Cons

- Limited marketing tools compared to dedicated CRMs. It lacks features like detailed email marketing.

- Some advanced features, like lead scoring and HIPAA compliance, are only available on higher plans.

- Occasional performance issues have been reported by users, especially during high-traffic usage.

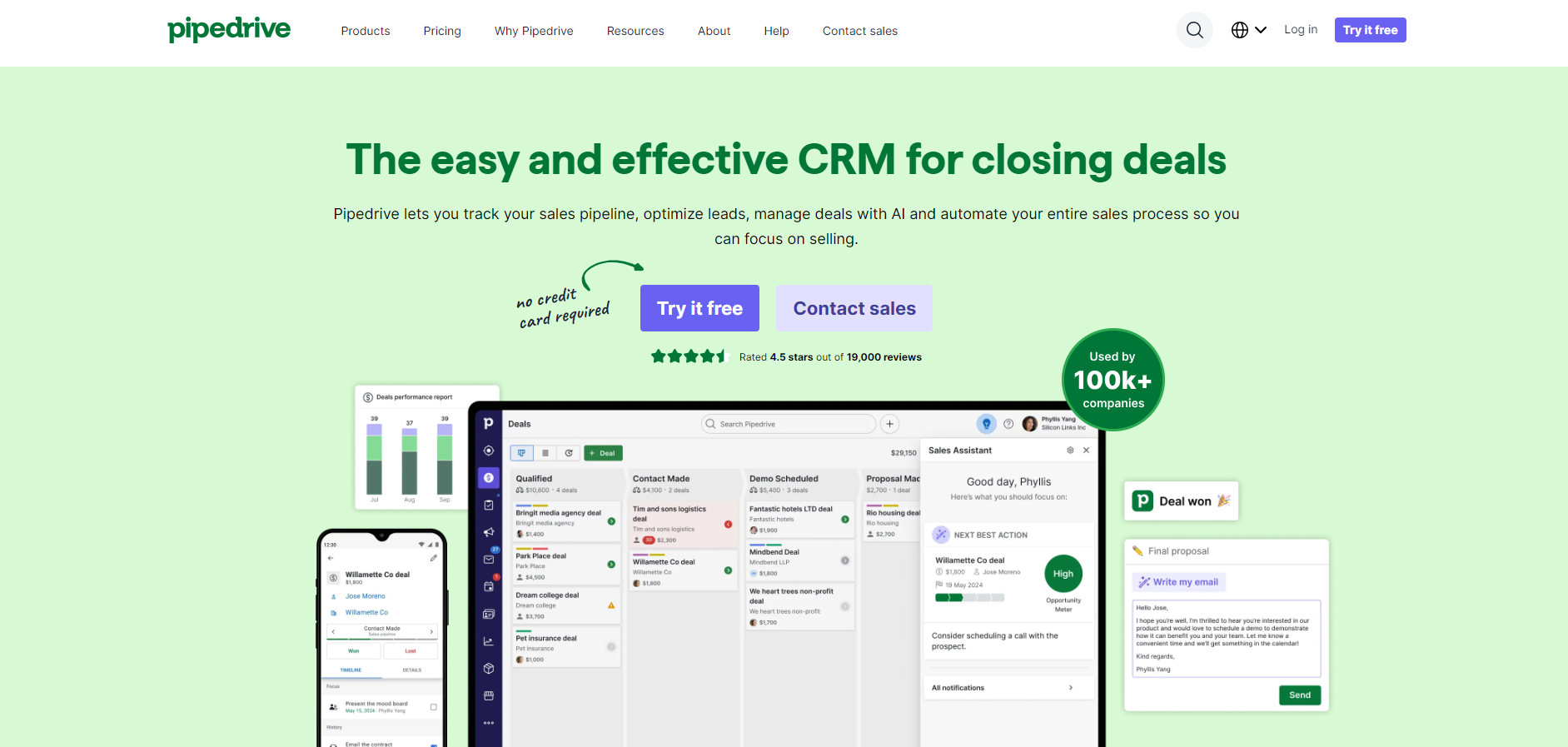

6. Pipedrive CRM

Pipedrive CRM is a visually intuitive, sales-focused CRM tailored to help businesses efficiently manage their sales pipeline. Known for its ease of use, Pipedrive enables sales teams to track leads and deals with customizable pipelines that match their unique sales cycles.

Made primarily for small to mid-sized businesses, Pipedrive offers tools like a Leads Inbox, visual pipelines, and an AI Sales Assistant that helps teams focus on high-priority deals. The platform also features email integrations with Gmail and Outlook. It allows users to send, receive, and track emails within the CRM.

With a range of automation options and a mobile app, Pipedrive is well-suited for sales reps on the go. Therefore, it’s a top choice for teams looking to streamline their sales processes effectively.

Key Features

- Visual Sales Pipelines: Customizable Kanban-style pipelines for tracking deals across stages.

- AI Sales Assistant: Provides insights and weekly progress reports to optimize sales efforts.

- Leads Inbox: Dedicated area to manage incoming leads and organize them before qualifying.

- Email Integration: Sync with Gmail or Outlook, track emails, and use templates.

- Smart Docs: Manage documents like proposals and quotes with e-signature capabilities.

- Workflow Automation: Automate repetitive tasks such as follow-ups and deal progression.

- Mobile App: Offers offline access and call logging for field reps.

- Integrations: Over 300 third-party apps like Slack, Trello, and Zapier available.

Pros

- User-friendly and highly visual interface, ideal for quick setup and pipeline management.

- Comprehensive email integration and tracking are available in higher plans.

- Robust third-party integrations allow users to expand their capabilities.

- AI-driven recommendations for improving sales performance and task prioritization.

Cons

- Limited customization and reporting on the lower-tier plans.

- Additional tools like lead generation and document management require paid add-ons.

- Primarily focused on sales functions, it may lack features for extensive marketing automation.

7. HubSpot CRM

HubSpot CRM is a comprehensive, user-friendly platform. It is ideal for small to medium-sized businesses looking for an all-in-one solution to manage customer interactions across sales, marketing, and service.

Its free plan includes essential CRM features for contact management, deal tracking, email integration, and live chat. This makes it a popular choice among budget-conscious teams.

HubSpot also offers paid plans that add more advanced tools. This includes automation, advanced reporting, and lead scoring, which can streamline operations as a business grows.

With seamless integration into HubSpot’s ecosystem and third-party apps like Slack, Zoom, and Google Workspace, HubSpot provides a versatile solution for both startups and established businesses.

Key Features

- Contact and Deal Management: Track customer interactions, manage contacts, and organize deals within a visual pipeline.

- Email Tracking and Automation: Send and track emails with automated follow-up options and monitor open rates.

- Live Chat and Chatbots: Engage customers in real-time through live chat and automate lead capture with bots.

- Marketing Tools: Built-in tools for email marketing, social media management, and lead generation.

- Reporting and Analytics: Customizable dashboards and detailed reports for contacts, deals, and team performance.

- Lead Management: Lead scoring, segmentation, and nurturing capabilities for targeted outreach.

- Mobile Access: Apps for iOS and Android with full access to CRM features on the go.

- Integrations: Over 300 integrations are available with HubSpot’s marketplace, including Slack, Trello, and Zapier.

Pros

- Offers a robust free plan, including core CRM functions for unlimited users.

- Intuitive interface with a minimal learning curve, ideal for new CRM users.

- All-in-one platform with marketing, sales, and customer service tools.

- Extensive integration options with third-party applications and HubSpot’s own ecosystem.

Cons

- Advanced features, such as detailed marketing automation, require paid plans.

- The learning curve can increase with more complex functions and higher-tier plans.

8. Flowlu CRM

Flowlu CRM is an all-in-one business management platform that supports various operational needs, including CRM, project management, financial tracking, and team collaboration.

It’s designed for small to mid-sized businesses, particularly those in B2B and service sectors, who want a comprehensive system to manage customer interactions and internal processes.

Flowlu’s modular approach lets users access project-tracking tools like Gantt charts and Kanban boards. It also has financial features like invoicing, expense tracking, and a customizable CRM for managing leads and sales pipelines.

Additionally, Flowlu offers a client portal, allowing businesses to collaborate with clients and share documents securely. The platform’s integration options with tools like Gmail, Slack, and Stripe further enhance its utility as a centralized management hub.

Key Features

- CRM Management: Fully customizable pipelines, lead tracking, and client profiles for targeted relationship management.

- Project Management: Tools like Gantt charts, Kanban boards, and task dependencies for visual tracking.

- Financial Management: Integrated invoicing, expense tracking, and revenue forecasting tools.

- Client Portal: Secure area for clients to access shared documents and communicate directly.

- Collaboration Tools: Real-time chat, task comments, and file sharing for seamless team coordination.

- Automated Workflows: Task automation for repetitive activities like follow-ups and task assignments.

- Mobile Access: Fully functional apps for iOS and Android. This allows you to manage your online business effectively from anywhere.

Pros

- Comprehensive feature set combining CRM, project management, and finance.

- User-friendly interface and easy-to-navigate setup.

- Flexible pricing structure, making it accessible for small and growing businesses.

- Excellent for collaboration with built-in communication and file-sharing tools.

Cons

- Limited customization options for specific workflows, such as custom fields.

- Some users report a steep learning curve, especially for advanced features.

- Fewer third-party integrations than some competitors, which may limit workflow flexibility.

- Mobile app functionality can be limited compared to the desktop version.

How to Choose a CRM for Your Small Business

To select the right CRM for your small business, we recommend considering these key factors:

Ease of Use

Your CRM should be intuitive and easy to navigate, allowing you and your team to get up to speed quickly. Small businesses benefit from CRMs that don’t require a steep learning curve or specialized training. This is why usability is critical.

Look for platforms with simple dashboards, clear workflows, and helpful support resources such as tutorials and customer service.

Essential Features and Customization

Identify the specific features you need, whether lead tracking, email marketing, or sales automation, and ensure the CRM supports these.

Additionally, having some customization options allows you to adapt the CRM to your unique workflows without adding unnecessary complexity.

Prioritize features like lead scoring, task automation, and reporting for efficiency in daily operations.

Scalability

Consider your business’s future growth and ensure your chosen CRM can scale with you. As your team expands and your customer base grows, your CRM should accommodate increased data, users, and features without needing a complete migration.

Many CRM tools offer scalable plans or modules so that you can start small and upgrade as necessary.

Integration with Existing Tools

To avoid data silos and enhance efficiency, your CRM should integrate smoothly with your existing tools, such as email platforms, accounting software, and small business marketing automation.

Compatibility with popular platforms like Google Workspace, Slack, and Mailchimp is a plus. This ensures seamless data flow across different functions and helps maintain a single source of truth for customer data.

Mobile Accessibility

Mobile access is a valuable feature for small businesses with on-the-go sales teams. A mobile app or responsive design allows users to update and access customer information, track tasks, and communicate with clients while away from the office. This flexibility is essential for maintaining productivity in fieldwork or remote environments.

Pricing and Value for Money

Choose a CRM that fits your budget without sacrificing core functionalities. Free and entry-level plans can provide essential features but check for user, contact, or functionality limitations. Also, be cautious about hidden costs, such as fees for integrations, support, or storage upgrades. Comparing these details helps ensure the CRM’s cost remains manageable as your business scales.

Final Thoughts

When choosing a CRM, it’s essential to view it as more than just a software solution. It’s a long-term partner in your business growth. The right CRM will evolve with your business. This software will enhance everything from customer acquisition to post-sale follow-up, all while streamlining daily workflows.

When assessing options, take advantage of free trials and demos. Involving key team members in these trials ensures a smooth transition and lets you gauge real-time user experience before fully committing.

As the CRM space continually innovates, staying informed about feature updates and new solutions can add significant value. This ensures your CRM remains a powerful asset in driving your business forward.

As your business scales and you leverage the power of a CRM, securing the necessary resources for growth is essential. At E-Boost Partners, we specialize in connecting small- to medium-sized businesses with the funding they need to reach their goals.

Whether you want to expand your team, enhance customer relationships, or invest in new technology, E-Boost can help you find the right financing solutions to fuel your next growth stage.