Checking your business’s credit health is vital for its financial stability and growth. Excellent credit health opens doors to better financing options, competitive interest rates, and stronger partnerships. To learn if your business is credit-healthy, you need to check your business credit score.

Business credit scores range from 0 to 100. Your business’s credit score informs lenders as they assess your business’s eligibility for credit products like business loans. A high score indicates that your company pays its bills on time, doesn’t incur too much debt, and is legally compliant.

Regularly checking your business credit score helps you build a credit history, making it easy to secure financing and partnerships.

Read on if you’re wondering how to check a business credit score. This article covers everything you need to know, including how to generate a free business credit report.

Why Is Your Business Credit Score Important?

Your credit score shows your business’s financial health and creditworthiness. Lenders, vendors, and other businesses use this score to determine whether they will work with your company.

A high credit score indicates that your business is low risk and qualifies for better lines of credit, larger credit limits, favorable loan terms, and better interest rates. It increases your borrowing power, increasing your chances of getting trade credit.

A business credit score also safeguards your assets, as you don’t need to use your personal credit or provide a financial guarantee to access business credit.

Additionally, monitoring your business credit history might protect your business from fraud by showing you inaccurate information or applications you didn’t make.

Business Credit Score vs Personal Credit Score

Is a business credit score similar to a personal credit score? While both scores indicate creditworthiness, they are different and have distinct implications.

A personal credit score is linked to your individual financial history. It ranges from 300 to 850 and is determined by your ability to manage personal debts like credit cards, loans, and mortgages.

Your personal credit score impacts your ability to secure personal credit lines, loans, and even some job opportunities. Timely payments, credit utilization, and the length of your credit history directly influence this score. Personal credit scores require an individual’s consent to access.

A business credit score, on the other hand, evaluates the creditworthiness of your business. It is based on your company’s financial activity, including payment history, credit utilization, public records, and trade credit relationships.

It also considers legal events that could affect creditworthiness, like judgments or tax liens. This score ranges from 0 to 100, with a higher score indicating a lower risk to lenders. Generally, a credit score of above 75 is considered excellent.

Unlike personal credit scores, business credit scores do not need a business owner’s consent to access. Individuals, companies, and the federal government can access them to determine a company’s financial health for various reasons, including financing and seeking contracts.

How Is A Business Credit Score Calculated?

Business credit scores are not standardized, as different business credit bureaus have various methods of calculating them. Therefore, you cannot compare scores from different credit bureaus. However, there are specific data points that these bureaus look at when determining credit scores. These include the following:

Payment History

Paying your bills, loans, and invoices on time builds trust with lenders and suppliers, positively impacting your score. Late or missed payments negatively impact your business credit rating.

Credit Utilization Ratio

This ratio refers to the amount of credit your business is using as opposed to the total credit available. Keeping it low—ideally below 30%—signals to lenders that your company manages its debt responsibly, which can boost your credit score.

Credit Age And Activity

A business with a long credit history and on-time payments is considered to have strong business credit.

Public Records

Business credit bureaus keep track of legal events that can significantly increase your credit risk rating, such as tax liens, bankruptcies, or judgments against your business.

Company Size And Financial Data

Bureaus check a company’s revenue, industry risk, and business structure when calculating credit score. Therefore, larger businesses with a demonstrated ability to handle financial obligations may have higher scores and access more extensive lines of credit.

Trade Credit Relationships

Positive relationships with suppliers and consistent payments toward trade credit accounts demonstrate your business’s reliability and financial responsibility. As such, it boosts your company’s credit score.

How To Check Business Credit Score: 4 Options

Regularly checking your business credit score lets you stay on top of your company’s financial health. There are several business credit reporting agencies that provide insights into your creditworthiness.

Here are some of the bureaus you can use to check your company’s credit score.

1. Dun & Bradstreet

Dun & Bradstreet is a credit rating agency that specializes in providing detailed credit insights and analytics to businesses. This credit bureau primarily uses the D&B PAYDEX® Score, which ranges from 1 to 100. An 80 or above is considered a good business credit score.

D&B also offers more specialized credit scores tailored to various business needs. These include the D&B Rating, which assesses a company’s financial stability, giving lenders and partners a broader understanding of potential risks. Dun & Bradstreet also gives predictive scores that gauge potential credit risk by analyzing payment history, trade references, and public records.

Once you sign up to the Dun & Bradstreet database, you get a D-U-N-S Number (Data Universal Numbering System Number). This unique, nine-digit identifier links your company to its D&B business credit file. Here, it stores your credit history, credit score, trade references, and public records.

Dun & Bradstreet offers these three credit insight tiers:

- D&B Credit Insights Free: This free business credit report gives limited access to your company’s credit profile. While it does not give you your PAYDEX® Score, it notifies you if the score changes, alerting you to shifts in payment behavior or credit risk.

- D&B Credit Insights Basic: This paid tier provides more detailed access to business credit information than the free version. For $49 a month, it gives you a full PAYDEX® Score, comprehensive credit risk scores, an in-depth business credit report, and real-time monitoring and alerts to credit score changes.

- D&B Credit Insights Plus: For $149 a month, this tier offers everything you get with Free and Basic and adds more features. These include dark web monitoring, comparing your score to other business credit scores, and predictive insights on potential risks.

2. Experian Business

Experian Business is a major business credit reporting agency that provides in-depth business credit scores, risk assessments, and predictive insights. It uses its flagship business credit score, the Intelliscore Plus℠, to evaluate a company’s creditworthiness. This predictive scoring model ranges from 1 to 100. Generally, a score of 76 or higher is considered a good business credit score, indicating low credit risk and timely payments.

Experian also provides additional credit scoring models like the Financial Stability Risk Score. This forecasts a company’s likelihood of severe delinquency or business closure.

Along with these scores, Experian evaluates public records, trade credit activity, and payment history. This makes it ideal for businesses looking for a well-rounded view of their company’s creditworthiness and financial stability.

Experian provides the following options:

- CreditScore Report: For a one-time fee of $39.95, Experian gives you a detailed business credit report, including Intelliscore Plus℠ and a full credit history analysis. This report is ideal for companies that need a quick, detailed look at their business credit score without committing to a subscription.

- ProfilePlus Report: This tier offers a more comprehensive one-time report, providing an in-depth view of a company’s credit profile for $49.95. It includes the Intelliscore Plus℠, Financial Stability Risk Score, payment history, and credit inquiries.

- Business Credit Advantage: For companies requiring a more comprehensive, ongoing analysis, the Credit Advantage tier offers monitoring and additional tools like credit score comparison and trade payment insights.

- Business Credit Score Pro: This tier is tailored for companies needing a detailed credit risk assessment to share with partners, lenders, or investors. It offers risk assessments, public records, reports for 30 other businesses, and trade payment analysis.

3. Equifax Business

Equifax Business provides essential data on a company’s credit history, payment behavior, and potential financial risk. It uses two main scores to assess business credit: the Business Credit Risk Score and the Business Failure Score.

The Business Credit Risk Score evaluates the likelihood of a company becoming severely delinquent within the next year. This score ranges from 101 to 992 and helps lenders understand the risk of extending credit to a business.

The Business Failure Score, on the other hand, predicts the probability of a business failing within a year, with scores ranging from 1,000 to 1,880. This predictive score is especially valuable for lenders, suppliers, and partners who need insights into a company’s long-term stability.

Equifax Business also provides detailed information on a company’s public records, including bankruptcies, liens, and judgments. The credit report incorporates trade payment history, credit utilization, and past credit inquiries. This offers a well-rounded view of the company’s financial standing.

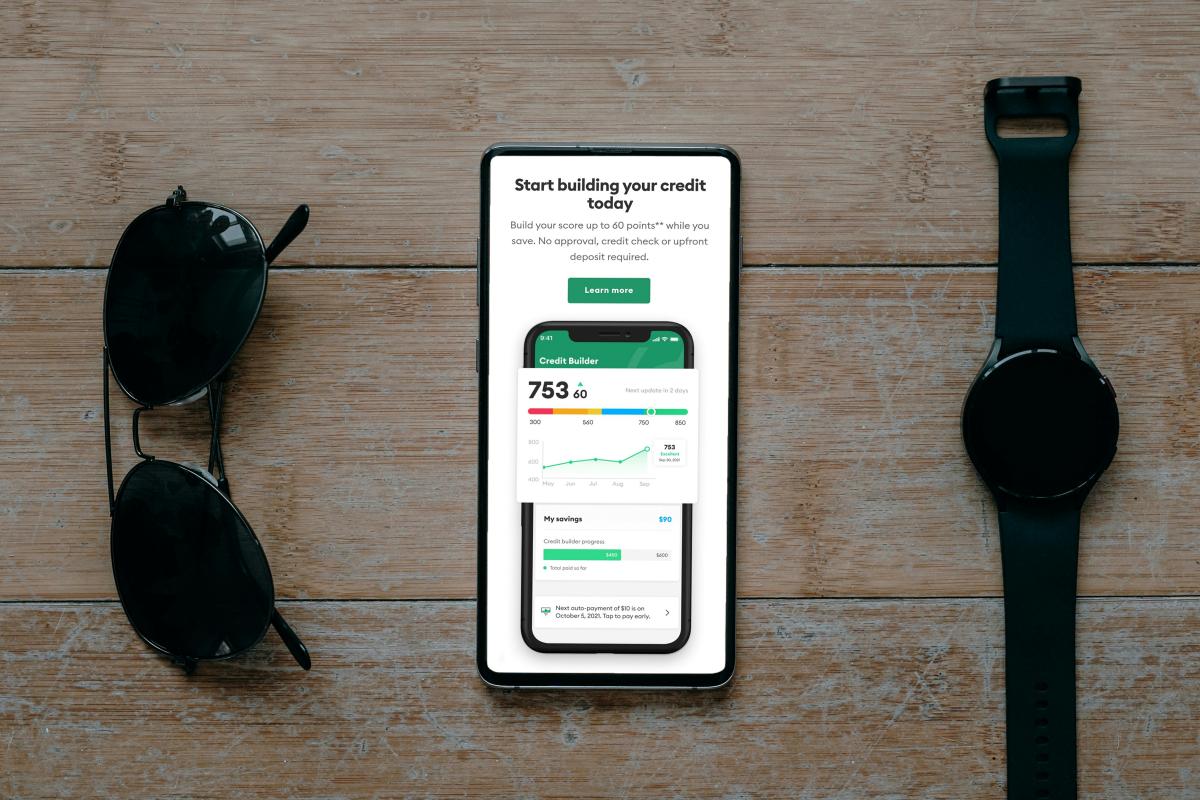

4. Nav

Unlike the previous three, Nav is not a credit bureau. It is a marketplace for free business credit reports that helps small business owners monitor and build their business credit. This platform relies on data from major credit bureaus like Dun & Bradstreet and Experian to give you access to your personal and business credit reports.

Beyond credit monitoring, Nav also provides personalized financing recommendations. It matches businesses with loan and credit card options tailored to their creditworthiness.

Conclusion

Constantly monitoring your business credit scores and building credit history is vital to your company’s success. A strong business credit profile opens up opportunities for financing at competitive rates. It also strengthens your relationships with suppliers and lenders, who view your company as a reliable and low-risk partner.

Actively managing your business credit sets your company up for success by giving it access to better lines of credit, favorable loan terms, and partnerships. Consider using the above bureaus to build a strong credit profile that gives you access to more business financing.

Ready to take charge of your business’s financial future by increasing your lines of credit? Reach out to E-Boost Partners for a business line of credit that lets you access cash when needed.